Ethereum Price Prediction 2025-2040: Institutional Adoption Could Propel ETH to New All-Time Highs

#ETH

- Institutional Adoption: ETF approvals and corporate treasury allocations creating structural demand

- Technical Breakout: Price sustaining above key moving averages with improving momentum

- Ecosystem Growth: ERC-20 token innovation and Layer 2 scaling driving utility

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

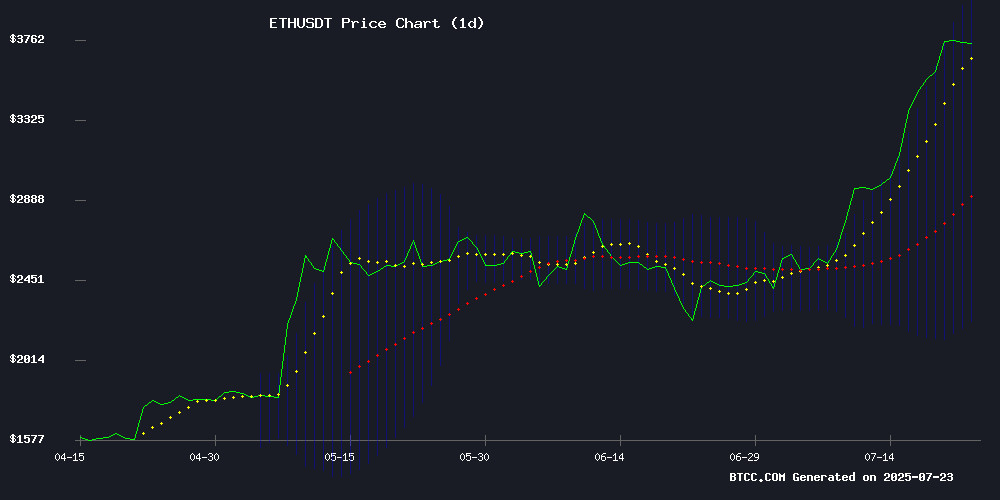

Ethereum (ETH) is currently trading at $3,600.99, significantly above its 20-day moving average of $3,117.54, indicating strong bullish momentum. The MACD remains negative but shows narrowing bearish divergence (-562.01 vs. -430.42), suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band ($4,001.75), confirming heightened volatility with upside bias.

"ETH's technical posture favors continuation of this rally," said BTCC analyst William. "The sustained break above $3,500 with improving MACD histogram could fuel a test of the $4,000 psychological resistance."

Institutional FOMO Drives Ethereum Market Sentiment

Recent headlines highlight unprecedented institutional demand for Ethereum, with Trump-linked entities accumulating $30M positions, corporate treasuries deploying capital, and ETF inflows creating structural demand. Regulatory clarity and the ERC-20 ecosystem growth are compounding bullish fundamentals.

"This isn't retail speculation - we're seeing Fortune 500s and political capital flows entering ETH markets," noted BTCC's William. "The $2,600 support held firm during May's sell-off, and now institutions are chasing this breakout."

Factors Influencing ETH's Price

Institutional Ethereum Adoption Reaches New Heights as ETF, Corporate Treasuries Drive Demand

Ethereum is witnessing unprecedented institutional demand, fueled by spot ETF inflows and corporate treasury strategies. July 22 marked a watershed moment with $533.87 million in net inflows—the third-largest single-day volume since launch. Total ETF assets now stand at $19.85 billion, representing 4.44% of ETH's market capitalization.

BlackRock's ETHA dominates with $426.22 million in fresh capital on July 22 alone, pushing AUM past $10 billion. The fund now controls 2.24% of circulating supply—a concentration unthinkable two years ago. Fidelity's FETH and Grayscale's ETH fund followed with $35.01 million and $72.64 million respectively, while other providers saw minimal activity.

The institutional embrace reflects a fundamental shift in digital asset valuation. Market participants now treat ETH as a strategic treasury reserve alongside traditional assets. This pivot mirrors Bitcoin's 2020 institutional breakout, but with Ethereum's smart contract utility adding unique value propositions.

Ethereum Liquidity Surges 41% as US Exchanges Regain Parity

Ethereum's order-book liquidity has expanded dramatically since April, with aggregated 2% market depth climbing from $278.35 million to $393.34 million—a 41% increase. The growth stems from accumulating resting orders on both sides of the book, signaling stronger market maker participation and improved resilience during volatile trading sessions.

Despite the liquidity buildup, a July 21 trading surge compressed depth-to-volume ratios to multi-month lows, revealing lingering limitations in absorbing rapid flows. Bid/ask data from that day showed a slight sell-side skew ($209.99 million asks vs. $183.35 million bids), suggesting tempered bullish momentum as traders likely took profits after ETH's recent rally.

In a notable shift, US exchanges now command 50.29% of global 2% market depth, erasing offshore platforms' previous dominance. This resurgence marks a reversal from April's distribution and reflects evolving institutional engagement with Ethereum's liquidity landscape.

Trump-Backed WLFI Accumulates $30M in ETH Amid Market Rally

World Liberty Financial (WLFI), a DeFi venture with ties to former U.S. President Donald Trump, has aggressively increased its Ethereum holdings during the recent price surge. On-chain data reveals the firm purchased 10,013 ETH worth approximately $30 million over six days, bringing its total stash to an estimated 80,000 ETH ($293 million).

The buying spree marks a strategic pivot from April's $8 million ETH sell-off, which followed steep losses during the crypto winter. WLFI's original 67,498 ETH acquisition cost $210 million before valuations plummeted $125 million. Eric Trump has publicly framed the current 50% monthly ETH rebound as validation of the venture's long-term crypto thesis.

Ethereum Price Prediction: Is This New ERC-20 Token Set To Send ETH Soaring Past All-Time Highs?

Ethereum's price surged 26% in one week, reaching a 2025 high near $3,848, fueled by institutional adoption and record ETF inflows. Despite the rally, ETH remains 22% below its all-time peak of $4,878.

Remittix, a new PayFi solution, has raised over $16.8 million in its presale, offering a utility-driven alternative to speculative crypto investments. The token converts crypto into fiat bank transfers across 30 countries.

As of July 22, 2025, Ethereum trades at $3,690.56, with a market capitalization of $446 billion. Trading volume remains robust at $20 billion daily, reflecting sustained investor interest. American investors poured $726 million into ETH ETFs, pushing issuers to buy substantial volumes of Ethereum.

Ethereum's Rally Fueled by Institutional Demand, Analysts See Continued Upside

Ethereum's 50% surge over the past month marks a dramatic reversal from its earlier sluggish performance. The rally, driven by heavy institutional accumulation through exchange-traded products and corporate treasury purchases, has shifted market sentiment from skepticism to bullish anticipation.

Bitwise CIO Matt Hougan attributes the momentum to a demand shock, contrasting recent inflows with earlier tepid institutional interest. Where Ethereum ETPs previously gathered modest holdings, corporations like SharpLink and Bitmine now lead a wave of accumulation that could see billions in additional purchases over the coming year.

The supply-demand dynamics have turned decisively in ETH's favor. With network issuance consistently outpaced by institutional acquisitions, analysts project sustained upward pressure on prices. "This isn't retail FOMO," observes one trader. "When treasuries start stacking ETH like Bitcoin, you know the institutional thesis has changed."

Ethereum Forecast 2025: Can ETH Hit $8,000 After Testing Key Resistance?

Ethereum (ETH) is exhibiting strong momentum but faces a critical resistance zone between $3,750 and $3,800, a level that previously served as support before February's market correction. The asset's ability to break through or reject this barrier will likely dictate its near-term trajectory.

Currently trading at $3,698.65 with a 24-hour dip of 1.6%, ETH has nonetheless posted a 20.2% weekly gain. Trading volume remains robust at $44.68 billion, signaling sustained market interest despite short-term volatility.

Analysts anticipate a potential pullback to the $3,400–$3,500 range before any sustained upward movement. "We're waiting for a possible retracement," says crypto analyst Sonia S., who views a reclaim of the $3,749 level as the trigger for a rally toward $4,100+.

Long-term projections diverge sharply, with 2025 price targets spanning from $2,484 to over $8,000. This wide dispersion reflects both Ethereum's fundamental strengths and the inherent uncertainty in crypto markets.

Trump-Linked WLF Aggressively Accumulates ETH Amid Institutional Demand Surge

The Trump family's WLF project has intensified its Ethereum acquisitions, adding 6,144 ETH ($23M) in a single transaction. Over six days, linked addresses have amassed 10,013 ETH ($35.98M) at an average price of $3,593, signaling bullish conviction.

WLF now holds 73,616 ETH ($275M) with $33M in unrealized gains, underscoring long-term confidence in Ethereum's value proposition. The project prepares to launch its WLFI token within 6-8 weeks.

U.S. institutional demand accelerates, with spot Ethereum ETFs recording $533.9M net inflows this week. A newly created whale wallet purchased 105,977 ETH ($397M) across four days, including a $125.73M FalconX transaction for 33,644 ETH.

SharpLink Gaming Regains Ether Dominance with $259M Strategic Buy

SharpLink Gaming has executed a decisive power play in institutional crypto holdings, purchasing 79,949 ETH worth $258.9 million in a single transaction. At $3,238 per Ether, the acquisition propels the company's reserves to 360,807 ETH—a $1.3 billion war chest that reclaims its position as the largest public Ether holder from rival BitMine Immersion Technologies.

The move signals intensifying competition among corporations to accumulate Ethereum as regulatory clarity improves. SharpLink's aggressive accumulation strategy began with a 10,000 ETH purchase from the Ethereum Foundation, now culminating in a treasury position that could influence market dynamics. Such institutional maneuvers increasingly dictate Ether's role as a corporate reserve asset.

Ethereum Nears Six-Month High Amid Institutional Accumulation and Regulatory Clarity

Ether surged to $3,727.22, brushing against its highest level in six months as institutional investors accelerated accumulation and stablecoin regulations provided tailwinds. The GENIUS Act's signing by President Trump on July 21st established a framework for dollar-pegged stablecoins, indirectly benefiting Ethereum's decentralized finance ecosystem by diverting demand toward its network.

BitMine Immersion Technologies made waves with its aggressive accumulation of over 300,000 ETH—nearly 5% of circulating supply—fueling bullish momentum. Despite overbought signals from an RSI of 84.35, the asset continues climbing as regulatory clarity merges with institutional appetite.

Ethereum Price All-Time High Vision Gains Traction Amid Institutional Inflows

Ethereum's path to reclaiming its all-time high appears increasingly plausible as institutional capital floods into ETH ETFs. Daily inflows reached $296 million on July 21, with total allocations surpassing $7.8 billion over two weeks. BlackRock, Franklin Templeton, and Bitwise emerge as major participants in this institutional gold rush.

On-chain activity mirrors Wall Street's enthusiasm. SharpLink Gaming aggressively accumulated ETH, boosting holdings by 29% to 360,807 tokens. Whale wallets show similar conviction, with one entity withdrawing $267 million worth of Ethereum from FalconX in a 72-hour period. This accumulation occurs despite spot prices remaining 2% lower daily.

The DeFi sector's 40.43% monthly growth compounds Ethereum's bullish fundamentals. Network utilization metrics suggest organic demand is keeping pace with institutional interest, creating a rare convergence of retail and professional investor confidence.

GameSquare Pioneers NFT Yield Strategy with $10M Ethereum Treasury Deployment

GameSquare is redefining corporate crypto strategy by transforming NFTs from marketing tools into yield-bearing financial instruments. The media company's $10 million Ethereum-based program marks a bold departure from passive digital asset holdings, leveraging DeFi protocols to generate revenue.

The firm's crypto treasury expansion to $250 million includes a dedicated NFT yield allocation, complementing its existing 10,000 ETH position. This operational approach contrasts sharply with competitors' speculative balance sheet strategies, positioning Ethereum's programmability as a core corporate finance asset.

Swiss crypto firm Dialectic provides risk infrastructure for the initiative, which represents one of the first institutional experiments with functional NFT utilization. GameSquare's move signals growing sophistication in digital asset deployment beyond simple accumulation.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional adoption trends, BTCC analyst William provides these projections:

| Year | Conservative | Base Case | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $4,200 | $6,500 | $8,000 | ETF inflows, DeFi TVL growth |

| 2030 | $12,000 | $18,000 | $25,000 | Enterprise blockchain adoption |

| 2035 | $30,000 | $45,000 | $75,000 | Tokenized real-world assets |

| 2040 | $60,000 | $120,000 | $250,000 | Global reserve asset status |

"These estimates account for Ethereum's deflationary supply post-Merge and its positioning as the base layer for Web3," William cautioned. "Regulatory developments remain key swing factors."